Once a symbol of middle-class wealth creation and rapid expansion, the UK’s buy-to-let sector now stands at a crossroads - reshaped by policy reform, economic volatility, and shifting investor priorities. Yet, far from retreating, the sector is showing signs of reinvention.

Buy-to-let mortgages, introduced in the mid-1990s, unlocked property investment for a new wave of middle-class landlords. Over the next two decades, the private rented sector flourished.

But by 2016, concerns were growing that landlords were crowding out first-time buyers. This prompted a raft of tax and regulatory reforms: higher stamp duty, reduced mortgage interest relief, and tighter regulations.

The interest rate hikes of 2022 added to the pressure, while today, landlords face further challenges in the form of the and new Energy Performance Certificate standards.

However, despite these headwinds, the sector is adapting. UK Finance reports 58,347 new buy-to-let mortgage approvals in Q1 2025 - a 39 per cent year-on-year increase. Loans for new purchases rose 61 per cent, albeit from a low base. And buy-to-let transactions accounted for 10.4 per cent of total property sales this year, suggesting continued investor engagement.

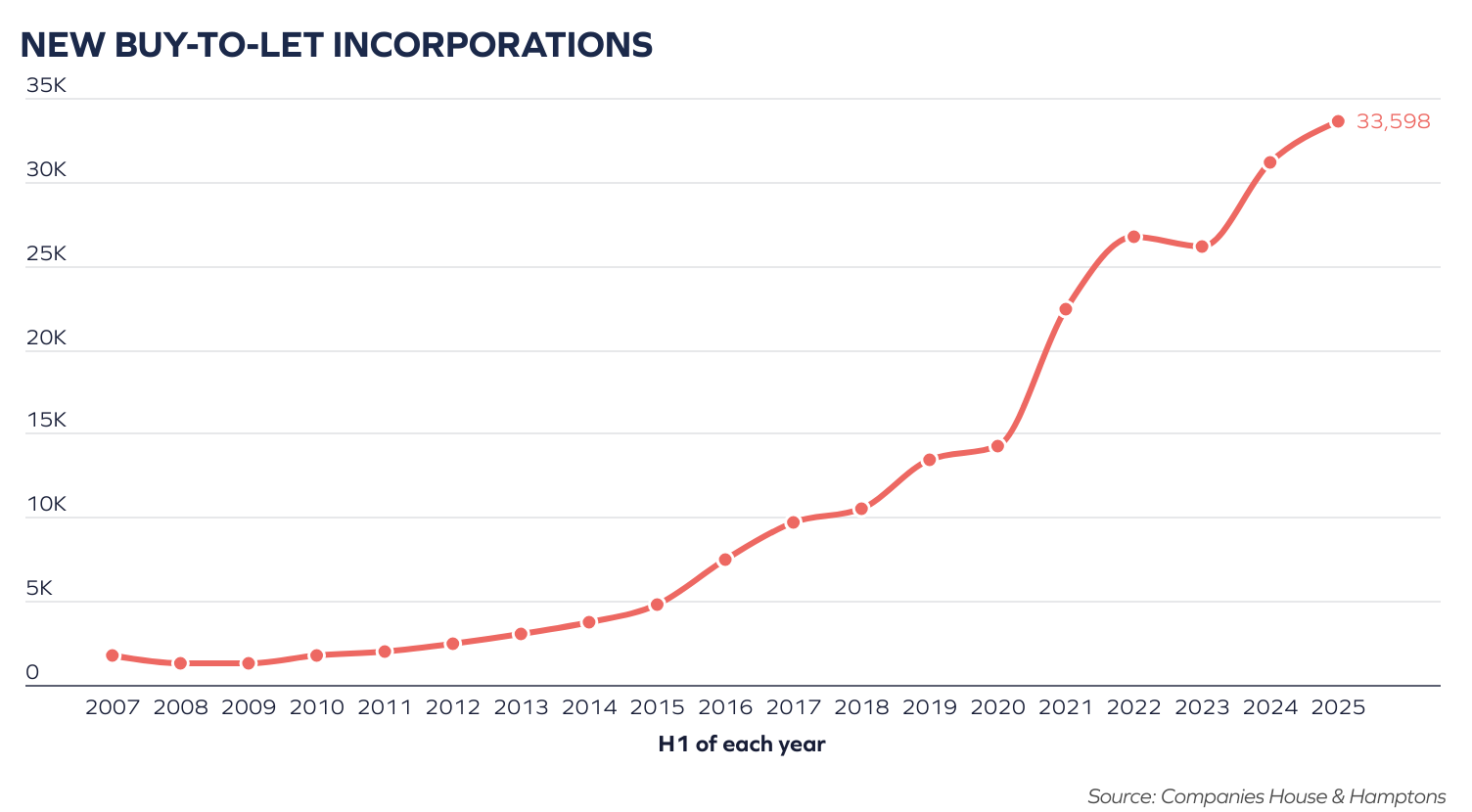

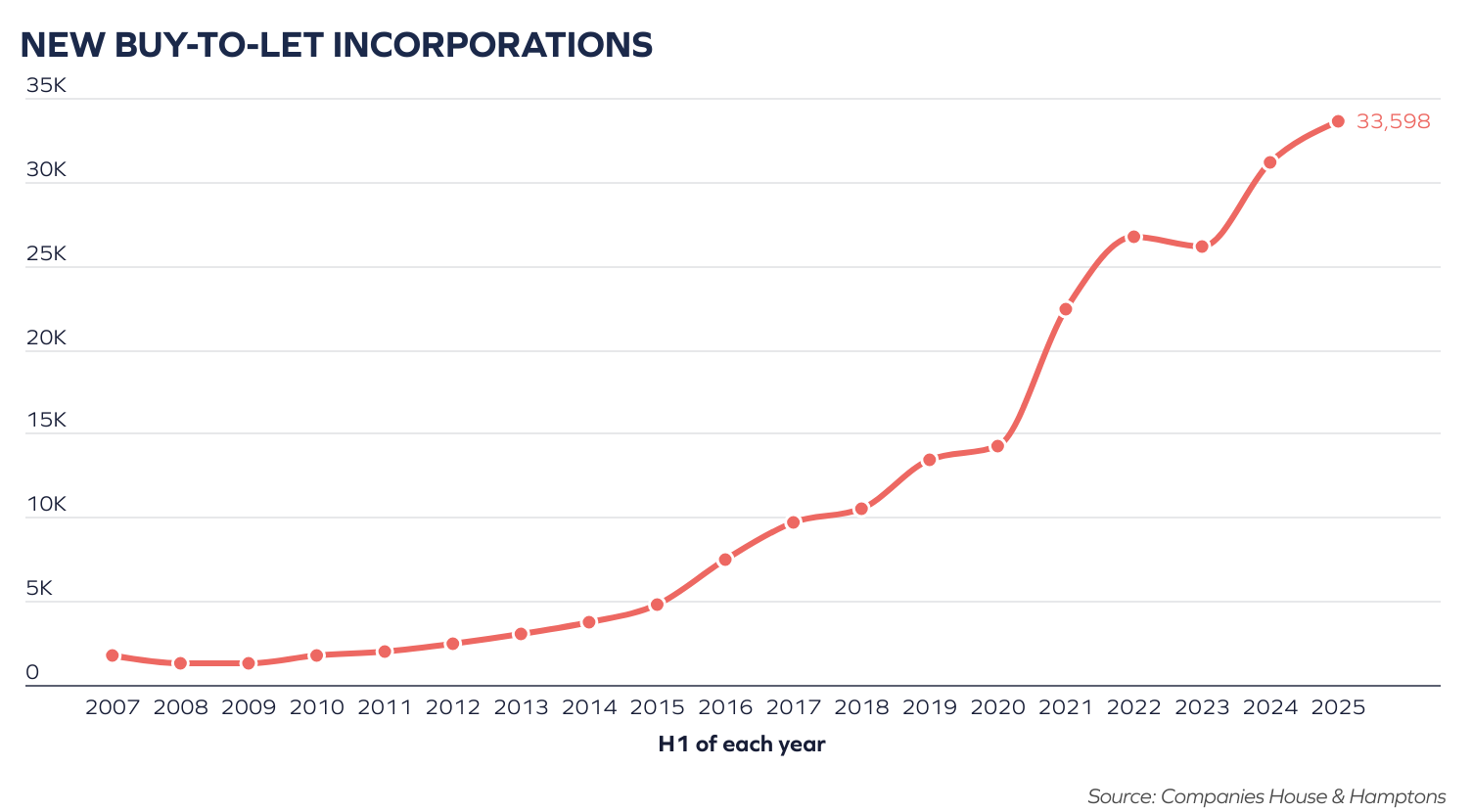

Incorporation trends underscore this resilience. A record 33,598 buy-to-let companies were established in H1 2025, with nearly three-quarters of new purchases now structured through limited companies.

Even after April’s increase, incorporations rose 18 per cent in May and 21 per cent in June year-on-year. This reflects not only tax mitigation strategies, but active portfolio expansion.

Improved yields are helping to offset rising costs. Gross yields on new purchases now average 7.1 per cent across England and Wales, with 25 per cent of landlords achieving double-digit returns. The with 9.3 per cent, while London - historically the lowest-yielding region - has seen returns climb from 4.1 per cent in 2020 to 5.7 per cent in 2025. These figures suggest a recalibration of risk and reward, particularly in regional markets.

The investor base is also evolving. Since 2016, the proportion of from 13 per cent to 20 per cent. Indian and Nigerian nationals now top the list of international investors.

Several factors underpin the ongoing appeal of buy-to-let. Property remains a tangible, income-generating asset in an environment of falling savings rates and economic uncertainty. With house prices now outpacing rental growth, investors may be seeking to lock in high yields before they peak.

Falling mortgage rates have also helped. For a sector reliant on leverage, even modest interest rate cuts can improve profitability.

Meanwhile, supply constraints persist. The UK’s rental market faces chronic undersupply, exacerbated by younger generations renting for longer and showing limited appetite to become landlords themselves. This imbalance is expected to support rental growth - at 3.5 per cent in 2026 and 3.0 per cent in 2027.

What emerges is a picture of gradual consolidation. The sector is becoming more professional, shifting from fragmented ownership to one where fewer landlords hold larger property portfolios in limited companies. Regulation, demographics, and returns are driving this evolution.

Buy-to-let may no longer offer the easy gains of its early years, but for investors willing to adapt, it remains a compelling long-term proposition.

Read more about our rental growth forecast .